How To Build Financial Strength For First Responders- Nick Daugherty

My very special guest today is known as the financial cop, Nick Daugherty. He has got some great information that pertains to financial wealth and wellness that ties into your mental health. He's gonna teach you how to set up a basic budget and how to pay off those bills and get outta debt. So you have that financial freedom now, and when you retire, this is a great episode. It ties into that mental health aspect because there's so much pressure with our finances. And as first responders working on this overtime, he's got some thoughts and theories on that.

My very special guest today is known as the financial cop, Nick Daugherty. He has got some great information that pertains to financial wealth and wellness that ties into your mental health. He's gonna teach you how to set up a basic budget and how to pay off those bills and get outta debt. So you have that financial freedom now, and when you retire, this is a great episode. It ties into that mental health aspect because there's so much pressure with our finances. And as first responders working on this overtime, he's got some thoughts and theories on that.

As a First Responder, you are critical in keeping our communities safe. However, the stress and trauma of the job can take a toll on your mental health and family life.

If you're interested in personal coaching, contact Jerry Lund at 435-476-6382. Let's work together to get you where you want to be to ensure a happy and healthy career.

Podcast Website www.enduringthebadgepodcast.com/

Podcast Instagram www.instagram.com/enduringthebadgepodcast/

Podcast Facebook www.facebook.com/EnduringTheBadgePodcast/

Podcast Calendar https://calendly.com/enduringthebadge/enduring-the-badge-podcast

Personal Coaching https://calendly.com/enduringthebadge/15min

Host Instagram www.instagram.com/jerryfireandfuel/

Host Facebook www.facebook.com/jerrydeanlund

Jerry Dean Lund (00:04):

Hi everyone. And welcome to this week's episode of a Enduring the Badge Podcast, I'm host Jerry Dean Lund, and I don't want you to miss an upcoming episode. So please hit that subscribe button. And while your phone's out, please do me a favor and give us a review on iTunes or our apple podcast. It says, Hey, this podcast has a great message and we should send it out to more people. So please take that 30 seconds to a minute to do that review. And just maybe by doing that, it'll push this up into someone's podcast feed that really needs this message. And for those of you filling a little stuck, whether you're a first responder or not, I created a one on one coaching program it's dedicated to creating personal insight, discovery of inner wisdom, motivation, and growth to empower you, to reach your truest potential.

Jerry Dean Lund (00:44):

You can find that information @jerryfireandfuel on Instagram, or you can go to Enduring the Badge webpage and find it under the Coaching tab. My very special guest today is known as the financial cop, Nick Daugherty. He has got some great information that pertains to financial wealth and wellness that ties into your mental health. He's gonna teach you how to set up a basic budget and how to pay off those bills and get outta debt. So you have that financial freedom now, and when you retire, this is a great episode. It ties into that mental health aspect because there's so much pressure with our finances. And as first responders working on this overtime, he's got some thoughts and theories on that. Let's jump right into this episode with the financial cop. How you doing Nick?

Nick Daugherty (01:32):

Doing good about yourself.

Jerry Dean Lund (01:33):

I'm doing very well this morning. I'm excited to talk to you about a topic that we've only covered kind of once on this show and maybe in this is gonna be a little bit different kind of version of how we cover some financial responsibilities, some financial plannings, the financial, how to not fall into traps and a whole bunch of other great stuff that all first responders and anyone listening right. Can benefit from this.

Nick Daugherty (02:00):

Yeah,

Jerry Dean Lund (02:02):

Let's tell the audience a little bit about yourself, Nick.

Nick Daugherty (02:04):

Well, uh, so it's like you said, Nick darty, I'm a semi-retired Sergeant from the grand Prairie police department here in the Dallas, Texas area. I stay semi-retired. I gave up my Sergeant stripes in August of 2017. I still serve as a reserve. Uh, but my only job as a reserve officer I thought was to teach my, my training class in the north Texas region, little that I know it would become a statewide class and extremely honored now that this has become a national entity where we travel all across the country, teaching about financial wellness topics.

Jerry Dean Lund (02:33):

I'm gonna ask you the obvious question. Why is this important <laugh>

Nick Daugherty (02:38):

Well, you think about the stress load that we are under in first responder land, especially my cops. And you think about the mental aspect and whether you're a cop or you're a firefighter, it doesn't matter where you're at. I mean, the, the mental wellness has taken a, a very, very front focus justifiably. So, and, um, a lot of people don't understand how much finances ties into that. I mean, you talk about what we're dealing with from a, an industry when it comes to suicides. And nobody likes to talk about that, but the reality is, is we're losing far many more, uh, of our brothers and sisters to suicide than, than being killed in the line of duty. And, you know, top two reasons for suicide in America are marriages and money and let's face it. We suck at marriages and we suck at money. Um, and now you throw a stressful job into the mix and it's just a recipe for disaster for us.

Jerry Dean Lund (03:31):

Yeah, yeah, no, I, I totally totally agree with you. Um, it, mental health is tied to financial health and marriage is, you know, all that health type stuff in a marriage is tied to a lot of, it's tied to finances. I mean, it's, you know, the, if you can be happy and broke, um, yeah, I guess to an extent, but like you said, that just puts a lot of stress on you to do that. And I think you have to really have a great mindset to kind of live in that type of situation and not want to do more, be more or be financially more fit.

Nick Daugherty (04:09):

Yeah. Yep. Completely

Jerry Dean Lund (04:11):

On the job like you, you're talking before we, uh, start recording this, you have some personal experience <laugh> that you can share to let people know how relatable you are.

Nick Daugherty (04:22):

Yep. So I didn't become a nerd because of anything I did in school. I didn't go get my degree in finance. I got my degree in criminal justice. I became a nerd when it comes to money because I got a PhD in doing stupid stuff with money. And, you know, when I came into law enforcement, I had a master war chest of $80,000 in consumer debt. So I, I had really fallen into the, the stuff I of wanting to buy stuff. I couldn't really afford using credit cards. Um, I was making more money than I ever made in my entire life before I was a cop, which is kind of what we do to our cops. We pay a lot of them more money than they've ever made in their entire life. And, and we started do, started doing stupid stuff with money. And, uh, I had a master war chest of $80,000 in debt.

Nick Daugherty (05:05):

$21,000 of that debt was tied up in one car stereo system. Uh, yes, one car stereo. Um, and so I had started working overtime like crazy. And I really kind of started to work my way as a rookie officer to the point where if I didn't work 20 hours of overtime almost every week, I couldn't pay my bills. And I started to get to the point where I was just exhausted. Um, I wasn't exhausted because of the job I was exhausted because I was working almost every day overtime. Yeah. And, uh, I, I really kind of got to a point. I hit a pivot 0.1 day when I got home, I, I was exhausted. It was about midnight and I'd worked my shift in patrol and I'd worked my five hours of overtime before I started. And I walked over to my kitchen table and added up all my bills for the first time. And that, that was the point that I realized I was $80,000 in debt. And I went crap. You know, I didn't realize I had dug myself that big of a hole. And, and that's really scary for us in our industry because it's not a matter of if it's, when you get injured, I was one injured, uh, injury away from complete financial ruin. Cuz as we know, you can't work overtime when you're on light duty.

Jerry Dean Lund (06:13):

Right? Yeah. I think that's, uh, that's pretty incredible to be in that amount of debt. And then, you know, just kind of finally realize how deep you were down in the, in the debt hole there. That must have been one incredible car stereo system. I've gotta ask. What kind of car was it?

Nick Daugherty (06:34):

It was a 2001 Honda Accord Coupe <laugh> um, I always joke and say, I, I wish I had a stereo. So I, I competed on the national level and I wish I had a stereo that I competed in how loud you can make your car. Cuz it's pretty cheap to throw a bunch of speakers in the car and make it loud. I competed in sound quality. How realistic can you make your car sound? Which is why it was so expensive. So I had 17 speakers in a Honda accord and you couldn't see any of them. They were all completely hidden studio quality sound. Um, it was an amazing stereo, but it was the single stupidest thing I ever did when it comes to money. <laugh>

Jerry Dean Lund (07:10):

So you weren't making your money back off your investment?

Nick Daugherty (07:13):

Yeah. After all said and done, when I got done with that car, uh, and all the stereos I had before that I had wasted over $30,000 in credit cards on stereo equipment and I maybe got four or $5,000 back on eBay. Um, it was, it completely ruined my car. Um, the scary thing is when it ruined the car, I was $7,000 upside down on the balance of the car. So I couldn't sell it for what I owed. Uh, but a buddy of mine said, you should go to grand Prairie Ford cuz they take care of us, grand Prairie cops, right? We all have a dealership that gives us good deals on cars. That aren't good deals by the way <laugh>. And so they ran my credit and said, don't worry about being upside down. And they allowed me to buy and roll that upside down equity and that accord into a, a, uh, brand new mock one Mustang, cuz you know, we all like to upgrade the cars and you know, a couple years later I decided to get rid of that car.

Nick Daugherty (08:01):

And I rolled that over to a fully loaded Acura TL that I didn't buy, I least. And I really fell victim to the FTO starter pack in law enforcement. Um, in my class I have a slide that says the FTO starter pack and it's what we do. Right? We, we, we get hired in this job. We make more money than we've ever made in our entire life. And the first thing we do is we go buy a lifted, upgraded truck. We buy a rifle, we get a tattoo, we date a nurse, a teacher or a dispatcher and we're broke. And that's what I basically fell for it. Hook line and sinker myself.

Jerry Dean Lund (08:32):

Yeah. Yeah. I, I feel like that statement's pretty accurate, pretty accurate. A lot of, uh, listeners are like mm-hmm, <affirmative> shaking their head and why is credit card debt so bad?

Nick Daugherty (08:45):

You know, I'm a big firm believer in becoming debt free. I've been through every guru's class out there, whether it's Dave Ramsey, Susie Orman, Jim Cramer, Kiosaki grant Cardone, the ones that hate debt, the ones that love debt. And I've always come back to the studies I've done on millionaires and, and the overwhelming consensus in the millionaire community is, is that millionaires don't use debt. Um, one of my, my favorite quotes is from a guy named Chris Hogan. He says, when you start to realize that pain interest is a penalty and earning it's a reward, that's a game changer. And unfortunately we use credit cards, vast majority of us use credit cards as our emergency fund. And so we rely on an institution that robs us on average, 20% of our income to funnel and pay for toys and or take care of emergencies. Um, I, from a credit card perspective, I in the class I talk about, does anybody want a good stock, uh, tip? Cause I do a lot. I, I also run a fiduciary only financial planning firm. And so I do a lot in the stock market and I always ask, does anybody in here wanna make 20% on your money guaranteed right now in the stock market? And of course everybody's like, yeah, yeah. Well, it's real simple. If you have a credit card, if instead you pay your credit card off, congratulations, you've made an average of 20% of a rate of return on your money with zero risk in the market. And as we, uh, film this podcast today, uh, we all know the market has been rough this year. Yeah. Well you can make your money back. If you got credit card debt and always tell people we always focus on credit card debt before we focus on investing.

Jerry Dean Lund (10:17):

Yeah. Yeah. That's a, that's a great point. That's the <laugh> cuz the stock market is so volatile right now and it's just been plunging and plunging, which that affects everyone's four 401k or 457, right?

Nick Daugherty (10:31):

Right. Yep. A hundred percent. Yep. Again, I am, uh, I'm gonna get done with this call today. I'm gonna jump back on the phone. We are calling every client we have right now just to put them at ease and go it's okay. The market is down. Yes. But let's, let's look at where we've been. Let's look at historically what has happened in yeah. Scary times. But uh, 100% of the time the market has always recovered and you know, while nobody can promise that's gonna happen. I always tell people if the market doesn't recover right now, we're all in trouble, including your pensions. And I highly suggest you go buy a bunch of bullets, guns, ammunition, those kinds of things. Cause you're gonna need 'em.

Jerry Dean Lund (11:05):

Right, right. I love how all first responders talk the same about <laugh> if, if something's gonna happen, make sure you have lots of ABO um, lots of weapons, weapons for 'em. So, um, so let's talk like a little bit of 1 0 1. Like how can we not as first responders fall in this trap? Um, of depending on, well first just the 1 0 1 maybe budgeting and depending on overtime.

Nick Daugherty (11:32):

Yep. Yeah. I always tell people the number one most important skill when it comes to building wealth is the least skill we love. And it's the last thing we think about. Everybody always wants to talk about retirement investing and you know, how do my pensions and those things. And to me, the most important number, one thing we must do is called the budget. It's the dreaded B word. And everybody hates budgets. People think that budgets restrict and I've had countless people tell me, Nick, I'm too old to be put on a budget. Well, nobody's putting anybody on a budget, a budget doesn't constrict you. It opens the door so that we can understand what we have, uh, for my folks that are getting close to retirement. When I have a retiree, call me and say, Nick, am I gonna have enough money to last? My answer always is what's your budget?

Nick Daugherty (12:18):

Say your budget will tell you if you have enough to live off of your retirement. And that starts and stops with what's called an every dollar budget. Every dollar has to have a purpose and a place before the months begins and we've gotta actually track it through the month. And I don't call it a budget anymore. For my cops, I call a budget, a SWAT rate. That's all it is. You know, every cop in America knows what a SWAT team does, you know, before they walk out the door that SWAT team's number. One thing they have to do is an ops plan. Yeah. What do we think's gonna happen? Where are we going? Where's the nearest hospital. What's my stack order. Who's breaching. Every second of that SWAT rate is planned out to the T and that's what an every dollar budget is. It's doing an ops plan before the month begins to plan out what we think we're going to spend.

Nick Daugherty (13:03):

But the most important thing that SWAT team does is not the raid. It's not the ops plan. It's when they get done, they go back to the station and they debrief or they do an after action. Did everything we think was gonna happen, go according to plan or do we need to change things to make it more efficient? Next time that's a budget. It's an ops plan before the month begins. It's debriefing throughout the month and it's doing an after action at the end of the month to make sure it went according to plan because a lot of people fall on the trap of budgets are the same. They're never the same, uh, may is not the same this year as last year. It's not gonna be the same as next year. It's, you know, June is not the same. Every month has their own traps.

Nick Daugherty (13:42):

Always talk about we, we have trap months built in. Um, and I give you a good example. We're in a trap month right now. It's the month of may. It's May, 2022. What's the trap. Well, the average family in America typically does their grocery shopping once a week on a weekend in may of this year, we have five weekends, most months have four. And if you don't account for that in your ops plan of crap, I got an extra week of groceries, especially if you've got kids, you're in a trap, you've just put yourself behind the eight ball for the next month. And those are the little things you start to look at and you go, okay, well, this wasn't about restricting me. This was just about making sure I've got enough money to cover things down the road.

Jerry Dean Lund (14:20):

Yeah. I, I like that. Um, but Nick, I just don't have time for this. Like I don't have time to, to do this planning. I I've got, I'm working so much overtime.

Nick Daugherty (14:31):

Yeah. I hear that all the time. And I, I, I, a budget is not that much. It doesn't take a lot of time. Yes. In the beginning it does. Um, it's a skill. Um, it's no different than in, I mean, think back to when you were a rookie cop, the first time you wrote a, a, a burglary of a motor vehicle report, it took you forever. And then about two years later, it was like, holy crap. I can get this done in five sentences. Bam, bam. I'm done. It's the same way with budgets in the beginning. Yes. It's gonna take some extra time. You're not gonna have one budget meeting. You're gonna have 10, especially if you're married, but over time it becomes such a learned skill. I mean, I've been doing budgets now for coming on 17 years. It literally takes me five minutes a month to do my budget before the month begins. And I track it. I actually do my budget every day, cuz I'm a nerd. Um, but I, I spend about one to two minutes every morning, reconciling my budget. And at the end of the month we go over it, it takes us five minutes to go over the budget. So over time the time commitment goes way down.

Jerry Dean Lund (15:32):

So you've changed your mindset on how you are looking at money and how, how important this budget is to you. Yep. And then, and you had to do that. I'm guessing through some, creating some habits or some rituals that you do. Yep.

Nick Daugherty (15:45):

Uh, completely it's, it's no different than going to the gym and working out, uh, for my cops. It's no different than spending the first five minutes of your day planning where you're going to lunch. Cuz that's the first thing we all do. Right. You know? Yeah. In time you can spend one minute on your budget and four minutes on where lunch is. Um, it's just a commitment to creating that habit. And once it becomes a habit, it becomes second nature and I help you hear people say I don't have time. And, and my, my response is what do you mean? You don't have time because I, I guarantee you 20 years from now. You're gonna look back when you're getting close to retiring and going, man. I wish I had made the time.

Jerry Dean Lund (16:21):

Yeah. Yeah. That's, that's, that's a great point. I'm gonna retire some in the near future. I don't know, a couple, one year, two years, something like that. But you always think when you're like, you see the end of your career or when you're gonna retire or how that's gonna kind of look and it, it doesn't really look the way you think it's going to look and especially financially planning, it's a whole different game. I think for first responders, cuz they're like, well I have a pension or I have this 401k and I'm just dumping money into my 401k and there's gonna be this great nest egg there at the end. Yep. And it's and if you didn't start in the beginning, right. Putting with your budget, figuring out your budget on what you can put into your 401k or 457, you're gonna find that nest egg at the end, quite a bit smaller than you need. Right? Yeah.

/401k-retirement-plan-beginners-357115_FINAL2-430f125e634544fe80440a1cf026eafe.png)

Nick Daugherty (17:15):

A hundred percent. And you know, EV I mean, we've taught about 25001st responders in the last several years. And uh, by far the number one thing I get on my evaluations, especially when I teach veterans, I wish I had been through. I wish somebody was around teaching this 20, 30 years ago. Yeah. Cause you look back as a young officer and you're like, Hey, where's the, where's the next party at, right. But then you get to retirement and you start to realize, and the longer you wait to prioritize your finances, the less you have of your most valuable asset when it comes to money and that's time mm-hmm <affirmative> um, you only have the time on this earth that you have on this earth. And you know, I start my class out with, with, with a quote. It says no excuses. It doesn't matter where we've been.

Nick Daugherty (17:58):

It only matters where we're going. We've all written the beginning chapters of our books and we can't change that. But the reality is we have the ability to change the future. And the other reality is, is that we're all millionaires. Uh, my first question in my class is how many of us first responders in this room got into this job to become millionaires and nobody ever raises their hand. But the reality is they all got into the job to become a millionaire. You see, if you take the average income of somebody from the time they start working, till the time they retire, your average person in this country, much less. A first responder is going to be handed somewhere between on average, three to 5 million in income. That's three to 5 million or sorry, three to 5 million pieces to the game of money that we have. And that puzzle pieces is that that's, that's the game we get to play. That dictates whether we retire broke, or we retire a millionaire.

Jerry Dean Lund (18:53):

Yeah, yeah, no, one's gonna retire broke. Right. They're just gonna keep staying and staying longer and longer in, in the career. I should say no one, but they they'll. They'll try to get out that, dig out that hole within five years and yeah, that's pretty much impossible, right?

Nick Daugherty (19:09):

Or, or we do what, what I hate to see, which is we retire from this job and we go back to work cuz we have to, not because we want to, um, I always tell people the pinnacle and retirement for me is that when you retire, you go back to work cuz you're bored. And if your boss makes you mad, you just laugh and walk out the door. You're not there for the money. You're there. You, it's funny. The, the people I work with that are in that boat, the, the quality of their life in retirement is so much higher. They go, they volunteer more, they find something they're passionate about. You know, I've got people that do woodworking now and they don't make hardly anything doing it. They don't care. It's not about the money anymore. It's about just killing time and they get a, they get a couple extra dollars every month for it. And it's just, they're, they're happy as can be.

Jerry Dean Lund (19:52):

Yeah. Find, they're find something that they're passionate about outside of being a first responder. I think that's super important as you look at retiring.

Nick Daugherty (20:01):

Yep. A hundred percent. I tell my rookies, you should be re you should be planning for your next career. The day you sign up. We, we get so many skills in this industry. And I mean, if you'd have told me I was gonna be a financial advisor and a financial wellness instructor, I would've laughed at you. But, uh, but once I realized that passion, I started working towards that goal to again, start to help people with this stuff.

Jerry Dean Lund (20:23):

Yeah. And I can see that you're very passionate about that. And I'm super grateful that you are, because this training is something that's needed for every first responder and the sooner, like you said, the sooner they get it the better. So I kind of wanna shift gears a little bit. Let's talk about wills and living wills.

Nick Daugherty (20:41):

Yeah. I hate this topic. Um, uh, I hate this topic with a passion because I shouldn't have to teach this topic, but it is the second biggest, most important topic we talk about. I hate it because I'd be willing to bet that 80% of the people that are watching this recording have never done a will. And that's just stupid. Um, especially since we have so many entities out there that will help us with wills. Um, and my state of Texas, you know, both the major police associations do a will for free for my cops. There's organizations out there like wills for heroes. Heck some of you have city office attorneys at the city, that'll do it for free and we're all gonna die. And we do a horrible job planning it. And I could give you countless horror stories out there, uh, of people that died in the line of duty and outside the line of duty that because we didn't have a, will it wasn't, it was just a mess. And so we've gotta do a better job of this, whether it's a basic will, whether we need to sit down with an attorney and do a, a full-fledged will or even broach into the trust aspect of things, uh, we've got to do a better job of getting a will in place for us as first responders.

Jerry Dean Lund (21:47):

Yeah. Why, why is it so messy if you don't have a will?

Nick Daugherty (21:50):

So in, in most states you have, what's called probate. Every state's a little different and you know, obviously it's, the laws are different with that. And if you die without a, will, you are now subject to the rules of that state's probate. So you basically have to go through their rules. Uh, typically this means you're gonna have to hire an attorney. That's gonna be a little bit more expensive because of the fact that we've got to navigate this, this, uh, uh, probate side of things, a will and most states still goes through probate, but at the same token, now you're dictating your rules. And so I always tell people, you know, imagine that friend of yours, that you love to death, but you would never want touching your money. <laugh>, you know, that may be who gets to help distribute your money. More importantly, for those of us, with kids, imagine having something God forbid happen to you and not having guardianship figured out for your kids.

Nick Daugherty (22:43):

And now I want you to picture that crazy aunt and uncle, you have, we all have one or two, and that may be who raises their children. And so tho that's the important now I gotta put my disclaimer, uh, I'm not an attorney I play, but I play one on TV. So in other words, I know enough to make me dangerous. So always consult with an attorney in your state for probate purposes or in state purposes. But you, you just, it, it typically gets a lot more complex, uh, especially if you pass away in the line of duty, cuz there's money involved. Now there's a lot of money involved and when money gets involved, uh, sharks start circling the waters and I've unfortunately seen countless, uh, people that are fallen or are survivors have fallen officers that have just been taken advantage of. Because again, there wasn't a plan and they became lottery winners and we all know what typically happens with lottery winners if they don't know what to do with money.

Jerry Dean Lund (23:33):

Right. Right. Yeah. And that's gonna just make that, you know, if something happens to you just make it that more, that's much more traumatic of an incident when you're not, when you have to deal with the finances on top of, you know, the other emotional aspects of things. So I could see why that would be. So I important and there it is, like you said so many opportunities to get it done for free. It's just once again, taking the time. Yeah. Taking the time

Nick Daugherty (24:02):

And it really broaches into, you know, the next topic about will and estate planning is what I call my legacy, go bag, uh, legacy planning. You know, if you died today, would your family know where to go to pick up the pieces of the puzzle and will and estate planning and legacy go bag goes hand in hand. And for my cops, we all know what a go bag is, right? We should, you know, most of us have a go bag in our squad car of extra ammunition, extra, you know, a little bit of food water just in case you get stuck on that long call. And so would, if you, if you died today, would your family know where to go? And so I have what I, what I call the legacy, go back concept where it starts to help organize that stuff. Uh, you know, where is your willingness estate plan at, you know, who is going to be your executor?

Nick Daugherty (24:39):

Who's going to, you know, be the gaurdian of your kids, you know, financial accounts, copies of statements so that your family knows you got a pension and this is the account number. I've got a bank account, you know, passwords and usernames to things. So your family can get in and pay the electricity bill, uh, or get into the bank accounts. You know, where are your important documents, those kinds of things. And, um, I'm gonna give a shameless plug. Cuz what we did is we created a, uh, a legacy go bag worksheet, uh, on my website, financialcop.com. If you go to the bottom of every page, there's a link that says, get your legacy, go bag worksheet. And it's a free 16 page PDF fillable document that will help you build your legacy, go bag as well.

Jerry Dean Lund (25:18):

That's very awesome. That's a, that's a great free gift for the listeners to go check out and uh, download. And definitely, uh, you, you don't want to go through something emotionally traumatic by losing someone, you know, in, in your family and then just not being prepared, you know, but most people don't wanna talk about this.

Nick Daugherty (25:40):

They bear their

Jerry Dean Lund (25:40):

Shit. That's why they don't do it. Right. They don't wanna talk about it.

Nick Daugherty (25:43):

<laugh> they bear their head in sand and it's it's, I, I don't have any scientific data to prove this, but I think my, my, uh, cops with families, uh, especially young kids are worse at this because I think that the number one thing that stops us from doing a will is the guardianship. If our spouse and ourself cannot agree on, who's going to raise the kids, we just bury our head in the sand and hope it doesn't happen. And it's kind of weird for me in law enforcement because we deal with death sometimes on a daily basis in this job, we go on the call, we go on the disturbance calls where the brother and sisters are fighting it out because, you know, I want this, you want, I mean, they're, they're fighting over this stuff. And then we don't correlate it to our own personal lives and realize that we've just put ourself in the same boat that we just answered a call for service and then went back and went car to car with a cop and made fun of these people because man, they couldn't figure it out. Who's gonna get the car or the ring or whatever. And it's like, you know what, but, but yet we're doing the exact same thing that they are.

Jerry Dean Lund (26:41):

Yeah. Yeah. That's <laugh> that's I think, and we know how fast people can pass away or just have a freak accident happen being in, you know, a first responder it's in just a blink of an eye, your whole world changes. And then you're falling into one of these situations

Nick Daugherty (26:58):

And we dealt with it. I mean, most of us have dealt with, unfortunately, a brother or sister that's been killed in a line of duty or we've dealt with a brother or sister that's died in a car, in a car accident, you know, buddy of ours or a friend of ours, you know, we've dealt with a that, but we don't, it's almost like put two and two to crap. My, my, my buddy are going to me or you that our family doesn't have to deal with the same thing.

Jerry Dean Lund (27:23):

Yeah. Yeah. That's, it's very, very important. How so? How do we protect ourself? Like maybe with some other financial stuff, like life insurance,

Nick Daugherty (27:36):

Unfortunately. And I always ask a very deep question insurance, if you died today and your family didn't have adequate life insurance, you know, those kinds of mentalities. And so I'm a firm believer in the minute you get married or the minute you have children, you need to have life insurance. If you're single with no, just to replace your income, I want your, uh, family or more importantly, I want, I want my wife and I want, want my there's all kinds of life insurance out there. I'm a big fan of term life insurance compared to all the other products, uh, you know, in the financial world, a lot of, uh, life insurance agents don't like term as much. Uh, the reality is they don't like term because they don't make that much money off of term. Uh, whereas they make a ton of money off the other policies. Uh, but again, to me, it's about what's best for you and what's the cheapest route we can get. And you know, typically I like about 10 times your annual income and life insurance to make sure your family's adequately protected.

Jerry Dean Lund (28:37):

Do you find a lot of first responders have life insurance when they're on the job and through, through their city or whatever their organization. And then once they leave, they don't have that life insurance policy anymore.

Nick Daugherty (28:50):

Absolutely. It's the most common thing I get asked about is, well, Nick, I got insurance through the city. Why do I need insurance outside of my city? Well, the reality is is that a hundred percent of us are going to leave our city. And whether you retire, you leave early, you quit, whatever we're gonna leave. And when you leave your employer, while you can keep your insurance through your employer, a lot of times, uh, you will not keep it because the cost of it goes up so much, you know, most term life insurance policies. If you want to keep it after you leave, you could only do so if it converts to whole life insurance and whole life is among one of the most expensive insurance products out there. And I'll give you my perspective. When I left grand Prairie PD, I was 38. Had I kept their insurance.

Nick Daugherty (29:29):

I could have kept $350,000 in life insurance. And it would've only cost me $450 per month only. Yeah, by the way, if I was 55, that was gonna be almost $1,800 a month. When I left, I redid my insurance. I bought a million dollar 30 year term policy and it cost me $88 a month. Um, now everybody's insurance can be a little different based on health ratings, but I always use that as kind of an example, because now it doesn't matter where I work for the next 30 years. If I die, my family's taken care of it doesn't matter if I have to change jobs all over the place my family's taken care of. And that's the number one priority to me in life insurance is to make sure that my spouse and my kiddos can maintain that lifestyle. If something tragically happens to me or vice versa.

Jerry Dean Lund (30:16):

Yeah. Yeah. That's super important that they maintain, you know, the same type of lifestyle. Once again, after going through something traumatic, you don't wanna have to really downgrade your, your lifestyle and, and add to the, the trauma of something like that happening. Um, far as other financial planning. What about your like pension? Right? Can we do, can we do any financial planning with their pensions?

Nick Daugherty (30:42):

Oh yeah, you can. Uh, you can realize that your pension's usually not enough to retire on <laugh>

Jerry Dean Lund (30:50):

Right.

Nick Daugherty (30:51):

I always always tell people I have a love, hate relationship with pensions. I love them because it's a guaranteed check for the rest of our life. For the most part. I hate them because they're a guaranteed check for the rest of your life. For the most part. Um, uh, far too often, especially my younger first responders. I hear them all the time say, Nick, I don't need to do a 457 plan or I didn't need, I don't need to do a Roth IRA. I got a pension. And then by the time they realize down the road, they need to start planning for this and that their pension's not going to be enough potentially to sustain them in retirement. We go back to that concept of they've lost the most valuable asset they have, which is time and it's the it's tougher to catch up. And so, um, the biggest things I wanna highlight with your pensions is everybody's got a different pension in this country. For the most part. They all have a lot of similar rules. Don't be afraid to talk to your pension folks, go to the seminars, talk to them, call your state pension board or your city pension, educate yourself on them. Stop getting advice on your pension from hallway gangsters.

Nick Daugherty (31:54):

So what's a hallway

Jerry Dean Lund (31:56):

Gang <laugh>.

Nick Daugherty (31:57):

So I was a school resource officer for several years. I got to work in an alternative campus where I work with the worst of the worst. And, uh, I'm a street cop at heart. So I, I volunteered for an underage alcohol and drug task force, uh, uh, unit for the weekend. So we'd go out on the weekend. So I'd get my street fixed and I'd, I'd see how these hardcore gang bangers out there on the streets, on, on the weekends. And then I'd see them at school. And to me, I, I always call them HGS or for hallway gangsters and, and they were a hallway gangster because on when I saw 'em on the weekends, it was really strange. It was, Hey officer Dardy, you know? Yes, sir. No, sir. Yes. I mean, they treated me like, I'm like, where's this respect all of a sudden, cuz cuz on, on Monday in the school, you cuss me out, you treat me like crap, cuz you're at the school and you feel more protected here. Well, we have people within our departments that think they know a lot about money and finances and they may, or they may not. And we take their advice as gold standard instead of becoming experts ourselves. And when it comes to retirement and pensions, this is one of the biggest financial decisions of your life. I always tell people, okay, I'm I, I may be a subject matter expert when it comes to pensions. But my favorite quote from Ronald Reagan is trust. But verify

Jerry Dean Lund (33:07):

<laugh> you can,

Nick Daugherty (33:09):

You can trust me as a subject matter expert, but you still better verify. I want you to call down to the state pension and I want you to verify what I'm telling you is correct, because it's too big of a decision. I spent an inordinate amount of time on the phone with, with first responders going, well, I heard you can do this with a pension. Who'd you hear that from, oh, this guy that retired six years ago. Well, you may have been able to do that back then, but you can't now. Well what do you mean? Well, let's, let's call the pension company and verify trust, put verify, right? Yeah. And so it's too big of a financial decision. You've got to become an expert in your pension. Not because you want to be a nerd, but because it's your pension.

Jerry Dean Lund (33:47):

Right? Right. And, and they are so different in even in the, the state of Utah where I'm, that there's different options, moving your money around, let alone how to invest. And uh, so there's there's avenues. I think people just, once again, like I said, the most I ask that they have is time. They're just signing up for the pension, throwing some money at it and then expecting maybe a lot bigger result on the end or start thinking about it when it's getting super close. And you, you just, you just don't have the, the money real right in your budget to financially make up time. Do you?

Nick Daugherty (34:25):

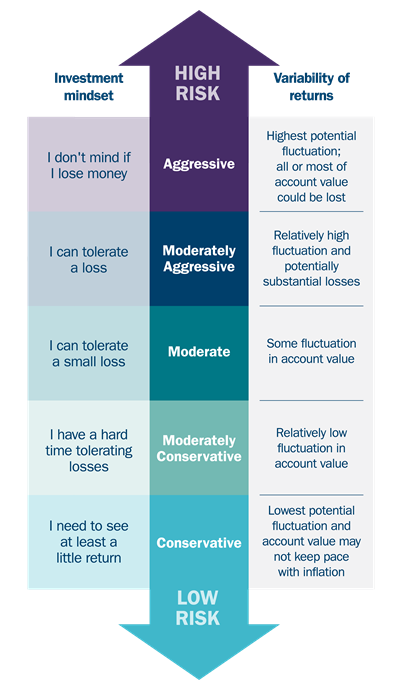

Yeah, it it's tough. Um, in, um, I, I see people make a lot of mistakes, uh, when they don't have as much time. I, you know, I, I give an example. I, I taught somebody recently that, you know, came up to me and was like, Nick I'm I'm, I'm close to retirement. And I had a million dollars in retirement and I have 500,000 now. I'm like, what the heck happened? And cuz the stock market's down, but it ain't down that much. And he is like, well, I, I, I, I decided to invest in Bitcoin. Yeah. Went, oh, I'm like, I'm, you know, I'm not gonna get into the logistics of whether Bitcoin is good or bad, but what I will get into the logistics of is that you've gotta understand your risk tolerance. And if your risk tolerance in your sixties is that of which you're okay with something doubling in value and then losing half of its value in a period of three months, um, that's a taller roller coaster ride than I'm willing to be on. And I do this stuff for a living. And so I see people take risk that are trying to catch up that may pay off a payoff may not. And we're playing, you know, roulette basically with our money cuz we realized we gotta be more aggressive when we could have not been as aggressive and protected our investments a lot more by being on a smaller rollercoaster ride.

Jerry Dean Lund (35:40):

Yeah. Yeah. I think Bitcoin is a rollercoaster ride. That's just something, um, I see a lot of maybe younger generations, um, investing in Bitcoin, but I'm like, I've said I'm I'm with you. I'm not it's hasn't been proven enough to not be so volatile. Yeah. That I would want to invest my heart, earn money into it.

Nick Daugherty (36:02):

Yeah. And, and I mean, and for you crypto lovers out there, I'm not anti crypto. I get a lot of hate for that. Sometimes

Jerry Dean Lund (36:08):

<laugh>

Nick Daugherty (36:09):

Um, I'm just anti crypto from the standpoint of most people that are dealing with it. Don't know what the heck they're doing and don't understand the risk associated with it.

Jerry Dean Lund (36:17):

Yeah. Yeah. What are some other financial pitfalls of first responders fall into that we haven't talked about?

Nick Daugherty (36:23):

So the biggest financial pitfall of first responders is failing to plan. We don't plan anything when it comes to money, which is really strange for me, for my cops. Because again, we talked about it earlier, the first thing we plan every day is lunch. It's the number one priority in our life is what, where are we gonna eat today? But what yet? We come home and we don't plan anything when it comes to money. And you know, that leads kind of into some of my other pitfalls, um, separate accounts. Um, I always tell people, I'm not here to tell you how to run your household financial situation, but I'm gonna tell you how we run ours. Um, me and my family, we, you know, for me and my wife, we have one joint account, all paychecks go in all bills, go out. Why transparency? You know, it's especially important. If you're like me, I have a CFO at the house, chief family officer

Jerry Dean Lund (37:10):

<laugh> yeah,

Nick Daugherty (37:11):

I don't get to do what I do without my chief family officer helping take care of the kiddos, uh, while I travel and those kinds of things. And so she needs to be able to have the trust that she can look at this at all times. And there's no worry about is money missing or what's this bill for. And you know, I also go back to one of the number one characteristic of millionaire, married people in America, uh, married, millionaires, playing everything together. They do everything together. They don't have separate accounts. They do all this stuff. And before you naysayers go out there, start going well. Yeah, but that's because they're millionaires and the largest study of millionaires ever done in the entire country, 11,000 millionaires were surveyed in a book called everyday millionaires. Uh, of the 11,000 millionaires surveyed 79% of them never received a dime of inheritance.

Nick Daugherty (38:01):

A third of them never earned more than a hundred thousand dollars in any given one year of their entire life. But yet they became millionaires. They don't drive new cars. 61% of them drive a used car, that's called a Toyota, a Ford or a Honda. And the top three careers for millionaires in that study. Number one was engineer. We would expect that number two was CPA. The third most common career for a millionaires out of 11,000 surveyed was teacher teacher. Wow. There's, there's a reason the book's called everyday millionaires. Cuz you have everyday millionaires walking around at your department that you'd never recognize because they just, they don't live these LAIs lifestyles. And so we we've, we've gotta understand that they, they plan together. They do this stuff together. Everything's done together. And you know, part of the issue with that is, is toys and or expensive purchases and vacations.

Nick Daugherty (38:54):

And I always talk about guys, I'm gonna pick on you for a second, but you know, there's, there's usually not always, there's usually a big difference between a guy going on a shopping spree and a girl <laugh> um, we come home with boats, you know, the dollar figures bigger. Right? Uh, I always joke and say, you know, my, my wife, Carrie walks in with a back full of clothes from the mall and I give her the evil look and she's like, shut up. I know how much you spend on speakers in that media room. <laugh> yeah. Old habits die hard sometimes. <laugh> and she's right. And so how do you alleviate that? Well, we alleviate that pitfall by doing a budget. You know, me and Carrie have a rule in our house. If one of we agree on our budget every month we go over it, we talk about it.

Nick Daugherty (39:34):

And again, it's not a confrontation, it's a work together type of conversation. And if one of us wants to go buy a toy out of our, uh, uh, uh, joint, uh, budget account, well, if it's over a certain dollar amount that we both agree upon, we have a rule, we must call each other and discuss it. You know? Yes guys, I said, call your wife and ask for permission to buy it. Basically <laugh>, you know, she never calls me because she's my natural saver. I'm the spender in the family, obviously with the speakers <laugh>. And so that's how we have that checks. I balance. Now we do, we are adults. We do need some autonomy in our lives. And so we create some autonomy by having what we call an allowance account. We both get a monthly allowance every month. And again, it's the same, no matter who makes more than the other, because we're equal.

Nick Daugherty (40:18):

We both agree on that allowance. And it goes to our own little savings checking account. And we have two purposes for that allowance account. The first is if I want to go buy her a gift, she doesn't know how much I'm spending on her. The second is we give each other more than we're gonna spend on gifts. So it grows over time. So if I want to go buy a toy outta my allowance account, she can't say anything at all. And you know, I love my son to death. He's 10. Now, when this story happened, he was seven. He was at that age. Where, when you told him, uh don't tell mommy, what does that mean? <laugh> Carrie has, Carrie has a rule for me. It's called no more guns. Um, I don't have a lot of guns, but she's like, you don't need any more guns, Nick.

Nick Daugherty (41:00):

And so we were out shopping one day, we get home and we walk into the kitchen and Carrie looks at us and she says, where you two boys been all day. And the first words outta that little turds mouth <laugh> daddy bought a gun. Yeah. Like Zach, we talked about this. Yeah. And so Carrie started to kind of gimme the evil look and my hand went up and that's just kind of become our universal sign with each other. And her entire demeanor changed. And she looked at me and she said allowance. And I said, yes ma'am. And she goes, oh cool. What kind of guns you get? And I always tell people what just didn't happen there. Yeah. We didn't have a fight. And more importantly, who was watching that interaction, my kiddo and the last financial pitfall is a first responder pitfall. It's overtime.

Jerry Dean Lund (41:44):

Yeah. We worked,

Nick Daugherty (41:45):

We worked too much overtime in this industry. You know, I worked a thousand hours of overtime in the first two years of my career to pay off all my debt. Really the first three cuz the first year is a wash. You don't work overtime when you're in training years, four through nine, I worked in additional 3,500 hours of overtime. Why I'm a bit of a workaholic. And so I just worked a bunch of overtime. My wife was on working days. I was on evening shift. I might as well go do something. And then on November, first of 2011, a commitment to my wife occurred and I quit working overtime, cold Turkey. My son Zach was born. And that was my rule for my wife is the minute we had kids. I was done cold Turkey. And the last five years of my career, I never signed up for a part-time job or overtime job.

Nick Daugherty (42:30):

Again, I could have paid my house off years ago, but I couldn't have been the baseball coach. And then Kylie came and you know, she's going to be the death of me cuz she's boy crazy. And she's only seven. Yeah <laugh> but you know, that's the most important thing in our lives is our family. And far too many of us in this industry give our family up for the job. Right. And a lot of it's because of the overtime cycle and the stress of money within our lives compounded with the stress of being a first responder.

Jerry Dean Lund (42:59):

Yeah. That's you're so right. I, and some overtime is, you know, kind of planned out there and sometimes it's spontaneous and they both have their impacts, you know, on, on your planning. But the younger you are and the more you depend on that overtime and like I'm constantly getting this check and then like, oh, what if something happens to the economy? And the overtime budget tries up?

Nick Daugherty (43:22):

Well, we had an entire year of overtime being gone, started March of 2020. And I took more crisis calls from cops in that 12 months than I've taken in the entire time I've ever done crisis coaching for this stuff. And because we had overtime budgets drawn or gone, so cops couldn't work overtime. And then we had spouses getting laid off in droves and mm-hmm <affirmative>, you know, at my city, we, we have unlimited overtime. Basically. We just it's, it's built in as part of our, our program. And one year they screwed up on that. And all of us top overtime earners got told in June that we could only work five hours of overtime, every pay period until October. And I remember there were men and women in that room that looked like ghost hit them. And I ended up getting called into the assistant chief's office separately, cuz I was a, one of the top overtime runners in the department and he goes, Nick, are you gonna be okay?

Nick Daugherty (44:10):

And I looked at him and I said, sir, with all due respect, thank you for the vacation. And he looked at me very strangely and he goes, huh. And you can imagine that wasn't the conversation he didn't having all day. And I said, sir, you know how we go on four vacations a year? He goes, yeah, I go, what do you think pays for it? He's like overtime, I go a hundred percent. He's like you remember how we bought a house a couple years ago? And we had to furnish the whole house and he looked at me, he goes overtime. I go a hundred percent furnish the entire home. That's what overtime's for. It's not to elevate your standard of living it's to build your financial strength. So I did my five hours of pay period. And then when October came around, went back to my normal routine until Zach was born and then I just quit cold Turkey.

Jerry Dean Lund (44:48):

Yeah. That, that was probably if you're not prepared for that it's life shattering to have like something happen, like no overtime, you know, and try to rebudget from that. Not like you said, elevating your financial. Um, however, I can't remember how you put it, but elevating that. So you're not dipping into your savings and other accounts that weren't really meant for that.

Nick Daugherty (45:16):

Yep. A hundred percent. And, and now we get back into the mental side of things, struggling with money. Yeah. Put the strain on our marriage, put the strain on our job. And the mental health starts to go down and I, I attribute, I'm not gonna say this is fully why I, you know, survived my 15 years almost in law enforcement without the same level of mental issues. Uh, I didn't deal. I never had to deal with PTSD or, or, or any of that stuff. Uh, you know, I've worked with a lot of people that have, and I completely get why they have are dealing with that stuff. I think I made it through without a lot of those issues because for me, I never had to worry about going home and struggling to pay bills and worry about that. I could always go home and talk to my spouse about things because a lot of times as cops, we have a bad day and we go home and we wanna talk about it, it to decompress, but we can't because the first thing we've gotta worry about is, oh crap. I don't know if I can pay my mortgage this month. And I never, we never had those conversations. It was, Hey, you had a bad day, you know, gimme a couple hours of decompress and then let's talk instead of the first thing. Always being money, money, money.

Jerry Dean Lund (46:20):

Yeah. Do you think part of the money issue is instant gratification when of buying these toys and buying these things instead of looking down the road and you know, maybe getting that gratification when you retire

Nick Daugherty (46:32):

A hundred percent. I mean, uh, everybody in law enforcement by now either knows of, or has heard of Dr. Kevin Gil, Martin's emotional survivor for law enforcement. And in, in that book, he talks heavily about the hypervigilant state, where we do these huge ranges of emotions, adrenaline dump, depression, adrenaline dump depression. Then we get off work and we're stuck in the depress mode. And he talks about how, how do a lot of cops get out of that? Well, sometimes they fall to addiction, they regress, they don't talk to people. And one of the things he talks about is retail therapy. I mean, I don't know about you, but if I'm, if I had a really rough week and I'm feeling down and I go buy a $70,000 truck,

Jerry Dean Lund (47:13):

I'm,

Nick Daugherty (47:14):

I'm probably gonna feel pretty good for a couple weeks until that first $900 payment hits my inbox. And so we get stuck in that hypervigilant state. You know, I'll give you another thing that he, you know, he talks about in that book, you know, top funny correlation, top years for the first burnout phase in law enforcement is between years five and eight. Guess when, one of the most common times for divorce in America is with a couple,

Jerry Dean Lund (47:38):

Yeah. I'd imagine probably between five and eight <laugh>. Yep.

Nick Daugherty (47:42):

And it there's a lot of correlations into that when it comes to the mental aspect in the financial. And that's why, you know, I, I teach for a, a national group called first responder conferences. And even when I go to other mental wealth conferences and teach for them, um, I've actually had several people in my evaluation say, I, I saw money, financial wellness in this conference and scratched my head and got went really. But now I understand why.

Jerry Dean Lund (48:08):

Yeah, yeah, yeah. Such a big role in, in our lives is there there's a, so there's eight phases to, for financial freedom.

Nick Daugherty (48:17):

Yep. Yep. I call it to eight phases of financial training. So every cop been through FTO phase, right. We go through field training and the beauty of field training is, is we start small and we progressively work our way up, right? We, and we don't go from phase one to phase five, we must do 1, 2, 3, gotta do an order. And so I call it the eight phases of financial training. So what is phase one phase one is that dreaded B word, the budget. Everything starts with the budget. We gotta do our ops plan. We gotta do our after action plan. We've gotta figure out what we have to work with. Phase two of training is to save $2,000 as a fully, as a baby emergency fund. I want you to have enough money in the bank so that if you walked out and there's a flat tire, you can write a check for that.

Nick Daugherty (49:03):

Cuz we're gonna go from the easiest step, which is phase two to the difficult, most difficult step, which is phase three, it's called the debt snowball, where we're gonna list all of our debts from smallest to largest. I don't care about interest payments. All I care about is is the balance and the monthly payment. We're gonna focus on the smallest balance. First we're gonna throw everything we can at that overtime part-time jobs, selling stuff, whatever we can, and we're gonna pay off that smallest debt and we're gonna free up that monthly payment. And then we're going to roll that into the next payment and always tell people it's really hard to lose weight in America with a tub of ice cream in the freezer. Cuz if you're like me, it's gonna get eaten. Yeah. <laugh>, it's really hard to lose credit card debt in America.

Nick Daugherty (49:45):

If you're still using credit cards. And so you gotta get rid of them during this time period, you can go back later. I do believe you can responsibly use 'em later on, but we gotta get rid of 'em. Now it's also really hard to lose weight in America because you work your butt off. And after a couple weeks you look in the, in the mirror and it doesn't really look like you've made that much progress. You don't see the change. Well, that's the beauty of a debt snowball. If you pay off that smallest debt, let's just say it's a $500 medical debt and you walk up to a refrigerator with a big Ole fat black marker. And you put a line through that smallest debt. You just physically saw the weight come off. And now we roll that $50 monthly payment into the next one.

Nick Daugherty (50:19):

Maybe it's a credit card. Maybe we knocked that out in a couple months and now we've got an extra $170 to pay on the next credit card. And you just repeat that over and over. And each time you pay off a debt, you become that's that much more financially stable. Um, I tell people all the time, let's say you've eliminated $600 in monthly payments by this, uh, using this method. And you have a bit of a hiccup. The water heater goes out well, you can tap the brakes on your snowball and use that $600. Plus your $2,000 emergency fund to get through that now. And you just repeat it over and over again, until you pay off all of your debt. This is the time where I want you working as much overtime and part-time job as, as you can. I want to accelerate that that's the beauty of this.

Nick Daugherty (51:00):

We get so much opportunity to work overtime and part-time jobs that we can accelerate a financial plan. We have the ability to actually make up some time with this. Once we're consumer debt free, everything, but the house. Now I wanna focus on using that extra payment to fully fund a three to six month emergency fund. Uh, I want you to have enough money in the bank so that if you lost your job, you could pay your bills for three to six months. Now you gotta do what makes you feel most comfortable? I like six months, more than three, but some people, uh, um, some people want 12 and that allows you to cover those unexpected. Now when the air conditioner goes out, we're not stressing over. Can I get credit for it? Or how am I gonna pay for this? We're just gonna write a check for it.

Nick Daugherty (51:40):

Cuz we've got that money saved up and then we're gonna start right back again. When we go through FTO phases, sometimes we struggle. Sometimes we have to go to remedial training. And when we're done with remedial training, we go back into the phase. So if you're in phase four of trying to pay off your or, or trying to build up your emergency fund and you gotta drop 10 grand on an AC unit, guess what you get to do. You get to do remedial training. You get to start focusing on building that emergency fund back up. Even if you're all the way on phase seven, we go back to phase three to remedial. We build it back up. Then we can go back to phase seven. After this're debt free with a fully funded emergency fund, you gotta make sure you start to build some fun into your budget.

Nick Daugherty (52:23):

I always tell people if you're debt free with an emergency fund and you wanna go spend $150 on a steak and lobster go do it. You've earned that right to start to live like no one else five, six and seven are done together. Five is retirement savings. I want you to focus on throwing at least 15 to 20% into retirement. So we've gotta pinch and subtract that out. And then after that, we gotta look at the secondary retirement accounts. And you know, whether we look at a 4 57 Def fur comp or a 4 0 3 B or a Roth IRA, this is where we gotta start diving more into the different types of an accounts, uh, uh, that may or may not be best for you after we've done 15 to 20%, we go to phase six, which is save and invest for big purchases, got kids in college.

Nick Daugherty (53:07):

We need to, we, we need do we need to save for college funding for the kids? Do we wanna buy a Corvette? How are we gonna save for those big purchases? Phase seven is to pay off the house, throw every extra dollar you can at paying that house off as quick as possible. And phase eight is the pinnacle release from training build wealth like crazy, cuz you have no bills, but do so in a manner in which you remain humble because I want you to become insanely generous as well. Building money. I always tell people, whoever told you money, can't buy happiness was broke. You can have a lot of fun with money, but the most fun that I've ever had building wealths has been giving it away and supporting charities that we love and, and know help support our brothers and sisters. And that's the, the crutch of a little mini version of a demo of what the eight phases of financial training are.

Jerry Dean Lund (53:58):

Yeah. That was awesome. Those, those are, I could see how each one of those would work in my own personal life to, to build, to build wealth and um, also doing I'm like, oh yeah, I'm doing okay job. And there's definitely some areas I'm like, yeah, I can improving that. Yeah. So yeah, anywhere you find yourself right in those phases, you could definitely, um, jump in. Maybe you're well, yeah, like I said, go through those phases. Most people are, are probably needing to start phase one, but you know, if you're really good, you could maybe start at phase two.

Nick Daugherty (54:29):

Yep. Everybody's in a different phase and, and sometimes you may be doing very, very good phenomenally and then something knocks you off your rocker and you just go back to the phase of training where it knocks you down to and start over from there.

Jerry Dean Lund (54:41):

Yeah. Nick, where can people find you and follow you and go to find more information so they can take these phases and put 'em into action.

Nick Daugherty (54:53):

Yep. So we've got our website, financial cop.com. It's got all kinds of free resources on there. It's got blogs. Uh, it'll tell you what we do as a company. It's also got a financial wellness training section on there. Whether you want your to wanna bring this training to your department. We also have a virtual financial cop academy that you can go through from the website's perspective as well or your department. I have a lot of departments that are buying it for the whole department. Now you can follow us on Twitter or Facebook, financialcop.com and you can always email me@nickfinancialcopis.com as well.

Jerry Dean Lund (55:23):

Awesome. I could see the why the investment of departments would be so important as we talked a little bit about mental health and how that translates. I think it translates into every aspect of your job, right? Yeah. This whole, if a money's an issue at home and which causes other issues, you're not gonna be the happiest officer out on the road or a first responder out. Yep. Yep. Giving the, the respect and care you should be giving to whoever you're coming in contact with.

Nick Daugherty (55:49):

It's becoming more and more mainstream and I'm in Texas. We, we, I mean, you've, every chief has to go through this class, most sergeants and lieutenants. Uh, but it's starting to become more mainstream nationally. I mean, we're at, we're at up over 90 classes this year in 17 states books. So it's been, uh, it's been crazy, never in my wildest dreams, but it's been an honor to become the voice of financial wellness for my brothers and sisters.

Jerry Dean Lund (56:10):

Yeah. That's great. You have to give your little, uh, plug before you, before we sign off for the podcast today.

Nick Daugherty (56:17):

Yep. So, because I do run a financial firm, I have to give my financial disclosure. You've heard these before. I don't read as fast as they do on the radio though. So bear with me. The views expressed for that of the host and are for informational purposes only. And in no event should be construed as an offer to buy or sell securities opinions expressed or subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of an individual investors, either IFP advisors, LLC, IFP securities, doing business as independent financial partners, ER, affiliates offer tax or legal advice and interested parties are strongly encouraged to seek advice from qualified tax and or legal experts regarding the best options for your particular circumstances. Investment advice is offered through IFP advisors, LLC, doing business independent financial partners or registered investment advisor, IFP and financial cop are not affiliated. Ooh. Okay.

Jerry Dean Lund (57:10):

<laugh> good job, Nick. Good job. <laugh> thank you so much for being on the show, um, and making an impact, uh, in officer's lives or first responders lives by impacting their mental health through their finances. Yep.

Nick Daugherty (57:23):

Please honor to be here. Thank you, sir.

Jerry Dean Lund (57:24):

Yeah. Thank you.

Enduring The Badge Podcast (57:26):

Thanks again for listening. Don't forget to rate and review the show wherever you access your podcast. If you know someone that would be great on the show, please get a hold of our hosts. Jerry Dean L through the Instagram handles at Jerryfireandfuel or at enduring the badge podcast also by visiting the show's website, Enduring the badge podcast.com for additional methods of contact and up to date information regarding the show. Remember the views and opinions expressed during the show solely represent those of our hosts and the current episodes guests.

Nick Daugherty

President / Owner

Nick Daugherty began his career with the Grand Prairie Police Department (GPPD) in 2003 serving as a patrol officer, school Resource Officer, and underage alcohol and drug task force officer. In 2012 he promoted to the rank of Sergeant where he served as a patrol Sergeant, field training supervisor, fleet coordinator, and the criminal intelligence unit sergeant. He semi-retired in August of 2017 and continues to serve as a reserve officer for GPPD.

At a young age, Nick did a lot of irresponsible things with money, consistently partaking in “stupid tax” (the art of buying toys he couldn’t afford using credit cards). Before he knew it, he had accumulated over $80,000 in consumer debt, most of which was wrapped up in cars, car stereo equipment, and just “plain ole stuff.” He was tired . . . tired of being in debt and tired from being stuck in the overtime cycle just to keep afloat! Nick realized that he needed to educate himself on personal finances and work to get out of the hole he had dug for himself. He was introduced to the Dave Ramsey program and became an avid listener, supporter, and believer in the Total Money Make Over program. He sold a bunch of that “plain ole stuff” and worked over a thousand hours of overtime to get out of debt – which he achieved in 2007 and has been consumer debt free ever since!

A graduate and coordinator of Dave Ramsey’s Financial Peace University, Nick is also a certified Ramsey Solution Master Financial Coach* and has coached hundreds of first responder families through almost every type of financial crisis and sc… Read More